US GAAP includes a two-step process that first determines whether substantial doubt about the company’s ability to continue as a going concern is raised. If substantial doubt is raised, management then assesses whether that substantial doubt is alleviated by management’s plans. Unlike IFRS Standards, if substantial doubt is raised in Step 1 about the company’s ability to continue as a going concern, the extent of disclosure depends on the outcome of Step 2 and whether that doubt is alleviated by management’s plans. When management becomes aware of material uncertainties related to events or conditions that may cast significant doubt on the company’s ability to continue as a going concern, those uncertainties must be disclosed in the financial statements. The terms ‘material uncertainties’ and ‘significant doubt’ are important – this standard phrasing is expected to be used in the basis of preparation note to the financial statements. All of this means that the auditor must gain a detailed understanding of the environment in which a company is operating, and more specifically, an understanding of the particular market conditions affecting its operations.

What is the approximate value of your cash savings and other investments?

It can determine how financial statements are prepared, influence the stock price of a publicly traded company and affect whether a business can be approved for a loan. Suppose an entity knows it will be unable to meet its November 15, 2018, debt balloon payment. handr block, turbotax glitch may impact some stimulus checks from the irs The financial statements are available to be issued on June 15, 2017, so the reasonable period goes through June 15, 2018. But management knows it can’t make the balloon payment, and the bank has already advised that the loan will not be renewed.

Internal control over financial reporting

Related to the going concern of the company, auditors are not responsible for assessing the going concern of the company. That means the management of the entity is the one who has the main roles and responsibilities to assess whether the entity is operating without facing the going concern problems. These include decreasing sales revenue, economic slowdown, loss of key importance management, payment of long-term debt, or interest payable. When an auditor issues a going concern qualification, the way their opinion is disclosed depends on the structure of the business. He frequently speaks at continuing education events.Charles consults with other CPA firms, assisting them with auditing and accounting issues.

AccountingTools

The auditor should not only consider the intent of the supporting parties but the ability as well. If there is an issue, the audit firm must qualify its audit report with a statement about the problem. Some or all of the services described herein may not be permissible for KPMG audit clients and their affiliates or related entities.

Going Concern Auditing Summary

The entity is already in breach of its agreed overdraft and the bank has refused to renew the borrowings. The entity has also been unsuccessful in applying to other financial institutions for re-financing. It is highly unlikely that the entity will be successful in renewing or re-financing the $10m borrowings and, in such an event, the directors will have no alternative but to cease to trade. The bank have already indicated that they are shortly going to commence legal proceedings to force the company to cease trading and sell off its assets to generate funds to pay off some of the borrowings.

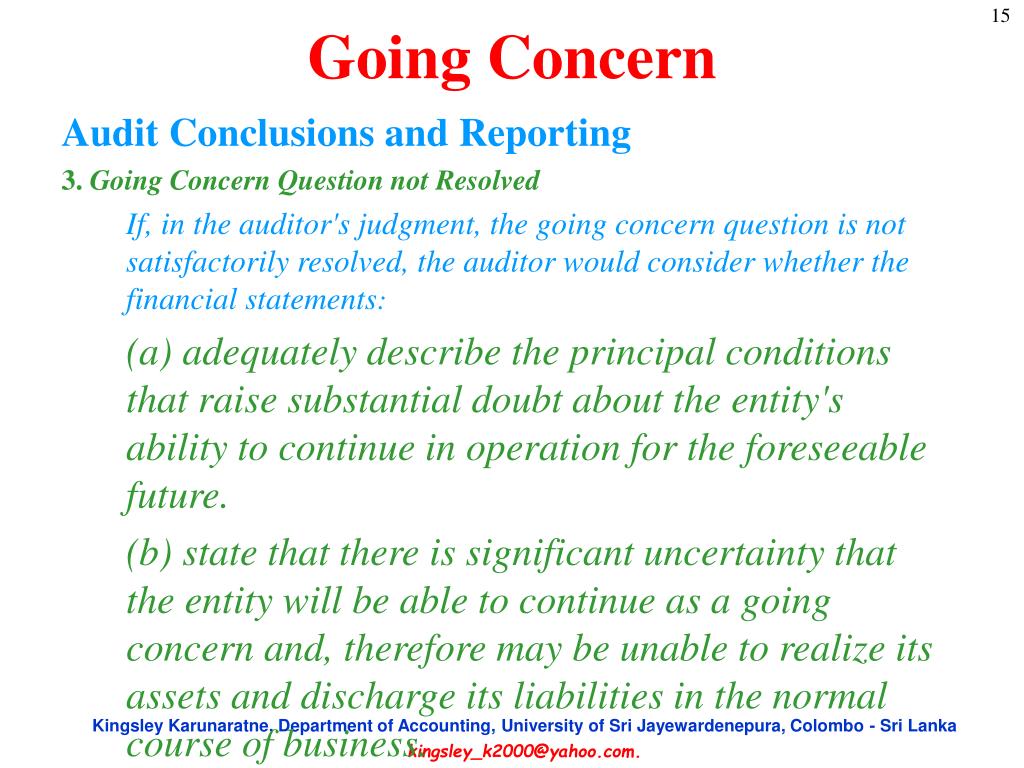

In order to assume that the entity has no going concern problem, the managements have to perform the proper assessment by including all relevant indicators that could cause the entity to close its business in the next twelve months period. In accounting, going concerned is the concept that the entity’s Financial Statements are prepared based on the assumption that the entity operation is still operating normally in the next foreseeable period. This foreseeable period normally has twelve months from the ending period of Financial Statements. The auditor should not use conditional language regarding the existence of substantial doubt about the entity’s ability to continue as a going concern. SAS 132 provides guidance concerning the auditor’s consideration of an entity’s ability to continue as a going concern.

Going concern is an area which should be front and centre of every audit and evidence must be challenged with the appropriate level of professional scepticism. In the exam it is important to remember that going concern is therefore not just something considered at a particular stage in the audit cycle, but should be an issue that permeates the whole performance and review of an audit. Performance Financial Statements Analysis is an important procedure in assessing the going concern.

The accompanying financial statements have been prepared assuming that the Company will continue as a going concern. As discussed in Note 2 to the financial statements, the Company has suffered recurring losses from operations, has a net capital deficiency, and has stated that substantial doubt exists about the company’s ability to continue as a going concern. Management’s evaluation of the events and conditions and management’s plans regarding these matters are also described in Note 2. The financial statements do not include any adjustments that might result from the outcome of this uncertainty. To meet these disclosure requirements, in our view, similar information to that in respect of material uncertainties may be relevant to the users’ understanding of the company’s financial statements, as appropriate.

Particularly in adverse economic environments, the going concern evaluation could be a significant undertaking for management. If conditions are changing rapidly, management’s evaluation may need to be updated frequently up through the date of issuance of the related financial statements. Management must also consider the likelihood, magnitude and timing of the potential effects of any adverse conditions and events. But going concern should be considered at all stages of the audit, not just in terms of specific procedures, and the auditor is required to remain alert to events or conditions which may cast significant doubt on the company’s ability to continue as a going concern.

- The problem created is that the audit firm may not be able to objectively assess going concern factors when in addition becoming involved with non-audit services pertaining to the going concern status of the company.

- It can determine how financial statements are prepared, influence the stock price of a publicly traded company and affect whether a business can be approved for a loan.

- Although some sectors and jurisdictions are more affected than others, all companies need to consider the potential implications for the going concern assessment.

- For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing.

- When management’s plans alleviate substantial doubt, companies need not use the words going concern or substantial doubt in the disclosures.

However, current economic and market conditions are likely very different from those of the past. Given the significant effects of COVID-19, management may need to reassess the company’s access to financing sources; they may not be easily replaced and the costs may be higher in the current circumstances. Further, other actions such as deferring capital expenditures or adjusting the workforce may be needed to generate enough cash flow to meet the company’s financial obligations. Impacts from a fall and winter COVID-19 surge may bring further uncertainty to many companies.

The concept of going concern states that all records are made on the assumption that the business will continue for the foreseeable future. Management should reassess the availability of financing because it may not be easily replaced and the costs may be higher in the current circumstances. Auditors must be extra vigilant in relation to the audit of going concern matters, and should also remember the possible ethical implications of being involved in non-audit services relevant to going concern.